If your client is in the market to purchase a home and need help with a down payment and closing costs, the Ohio Housing Finance Agency (OHFA) can help.

OHFA offers 30-year, fixed-rate conventional, FHA, VA and USDA-RD government loans with generous income and purchase price limits, designed especially for home buyers with low- and moderate-incomes.

Your Choice! Down Payment Assistance allows home buyers to choose either 2.5 percent or 5 percent of the home's purchase price. Assistance can be applied towards down payments, closing costs or other pre-closing expenses. This assistance is forgiven after seven years. If your client sells or refinance their home within seven years, he/she must repay all of the assistance provided.

Eligibility Requirements

Your clients may qualify for an OHFA home buyer program if they meet the criteria listed below:

income and purchase price limits; credit score requirements, conventional, USDA, VA and FHA 203(k) loans: 640 or higher; FHA Loans, non-203(k): 660 or higher; and debt to income ratios for your loan type.

Homebuyer Education Requirements

Qualified buyers are required to complete free home buyer education, and OHFA's streamlined education program allows you to complete a course offered by any U.S. Department of Housing and Urban Development (HUD)-approved counseling agency in Ohio. Please note, OHFA home buyer education is not completed until after home buyer has submitted their loan application with their loan officer. Home buyer Education is not required for borrowers who are only registered for their MTC Basic program.

To apply

OHFA works with lenders, credit unions and mortgage companies across the state. To find an OHFA-approved lender in your area, along with tips to help with the application process, call OHFA toll-free at (888) 362-6432.

CAHR Certified REALTORS®:

Bill Benninghofen

Kimberly Cecil

Deidra Corbett

Elton Davis

Melle Eldridge

John Grady

Mandy Harless

Michelle Helms

Angela Holloway-Williams

McHugh, Anita McHugh

Tonya Mitchell

Buffie Patterson

Carol Prigan

Connie Sadowski

Sameerah Salahuddin

Linda Schmidt

Mary Sguerra

Dominique Vacheresse

Sharon Young

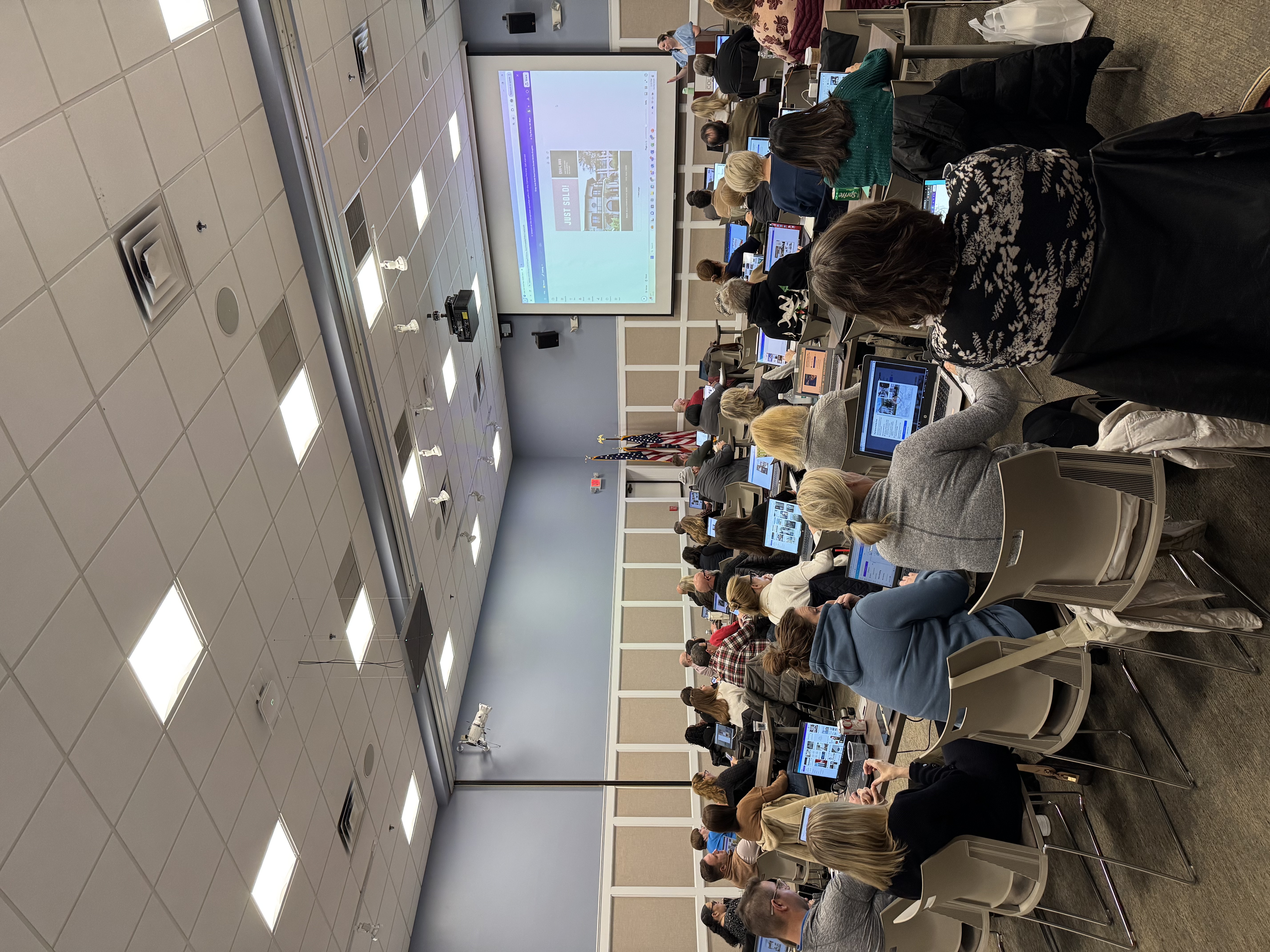

UPCOMING AFFORDABLE HOUSING LIVE FORUMS

What’s new in affordable housing lending?

Friday, September 14, 2018, 11a-Nn “Credit Improvement Movement”

Friday, October 12, 2018, 11a-1p

2 hr CE (pending); Cost: $20

Tax Strategies for Real Estate Professionals

Friday, November 9, 2018, 10a-Noon

2-hr CE (pending); Cost $20

All Live Forums are free and open to everyone and are held at Columbus REALTORS®.

Follow us on Facebook at:www.facebook.com/groups/AffHsgForum